What About Surveys?

- brian7764

- Feb 9, 2023

- 1 min read

Location Surveys and Boundary Surveys

On February 2nd, we had the pleasure of partnering with Bill Feller from McSteen Land Surveyors. There was a ton of great information presented! Specifically, the differences between a Mortgage Location Survey and a Boundary Survey.

Here is a little Chart to assist in comparing the two*:

| Mortgage Location Surveys | Boundary Surveys |

Price | $185-275 | $1,400 + |

Accuracy | Plus or Minus ft | Plus or Minus .02 feet |

Turnaround | Several Days | Several Weeks |

Standards | Provides Substantial Proof that the property is there and within property lines for Title & Lending Purposes | Determines the boundary lines for the property owner’s use (sometimes these are necessary for the county’s use if a new legal description is required) |

Shows | -Boundary Lines according to the Legal Description -all about the title company provided information & identifying potential title issues | -Boundary Lines as calculated by Surveyor -all about the Surveyor research and calculations to determine boundary lines |

*Information taken from McSteen Land Surveyors, GIS Mortgage Location Surveys and Boundary Surveys presentation on 02/02/2023.

Feel free to reach out to reply to this email if you are interested in receiving a copy of the presentation for future reference. Also, if you or a client is asking for contact information for a surveying company, McSteen Land Surveyors are wonderful to work with.

McSteen Contact information: Email: orders@mcsteen.com | Number: 440.585.9800

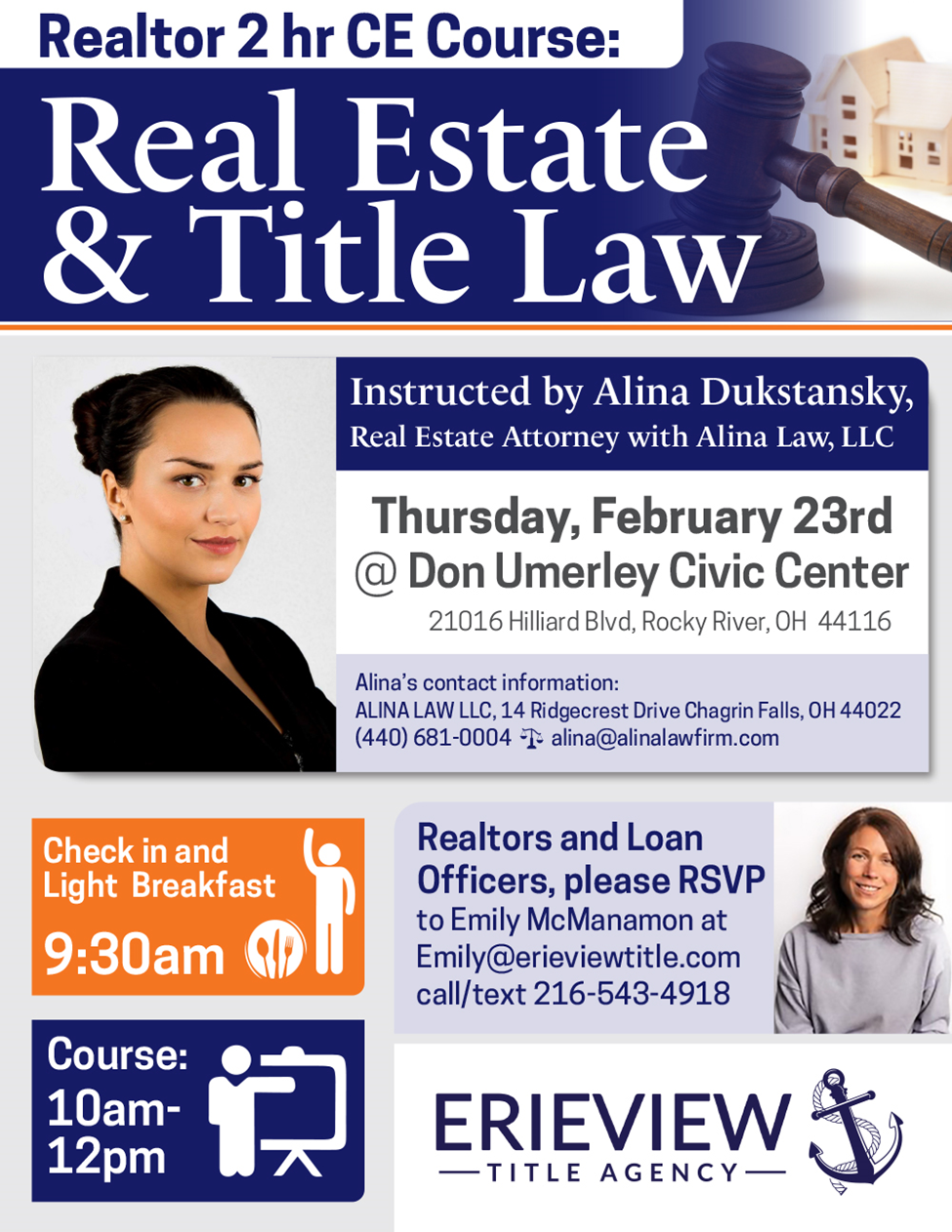

Last, we hope you can join us for a CE Course on Thursday, February 23rd on Real Estate & Title Law from 10 am -12 pm. Reply to this email if you would like to come!

As always, please let us know should you have any questions regarding this topic!

Comments